vega@polarvega.com

EUR USD has shown some strength, but EUR seems to be the weakest amongst all the Major currencies when comparing its move against USD. It needs to break above 1.025 and close above that area for making any higher move in the near future.

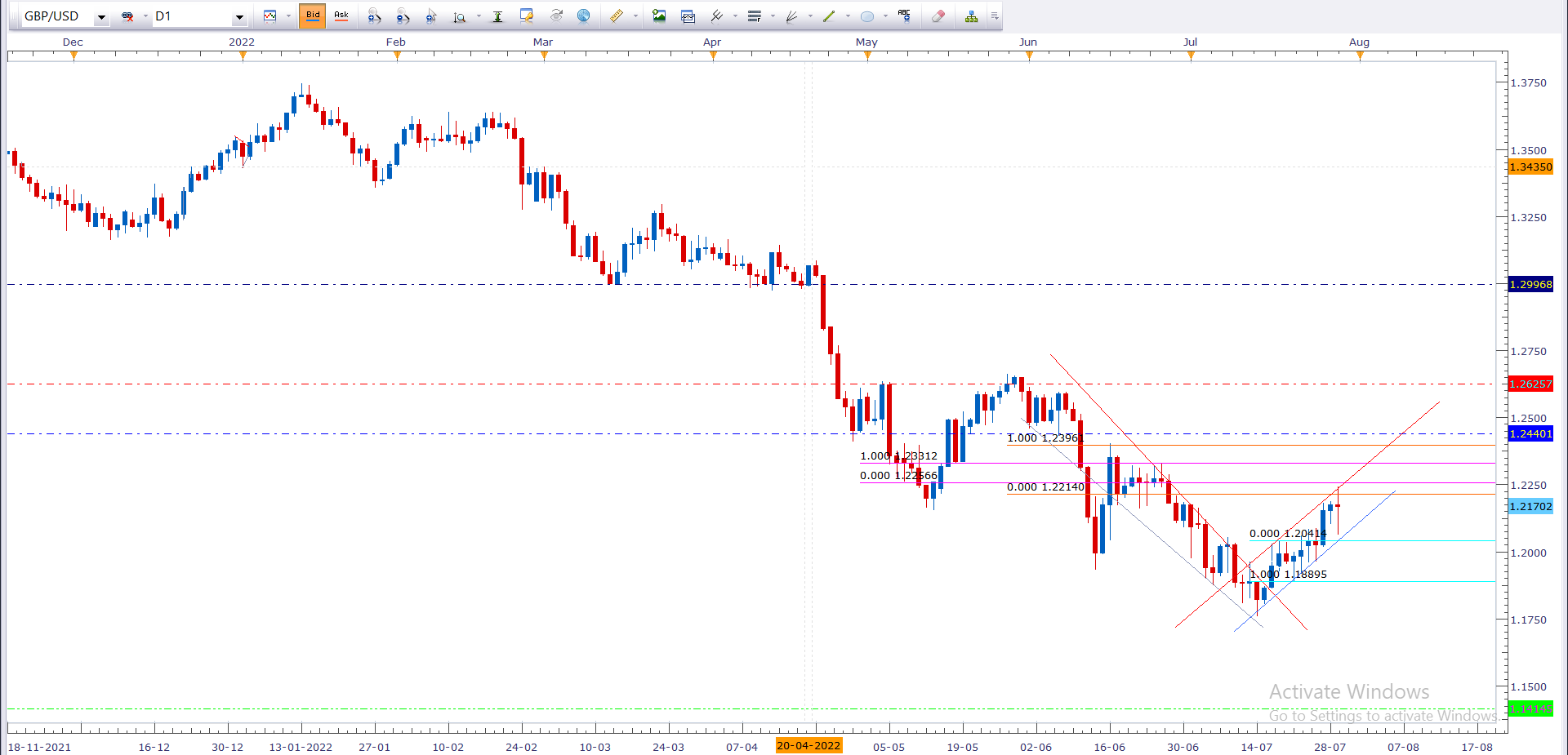

GBP USD printed a higher low in Week 31 but it has to break above 1.2440 and close above the area if the bulls are to move in and start taking Long term Long positions. until then SHORTS at SELLERS's zones are still a good trade to take. One has to be nimble in taking the targets.

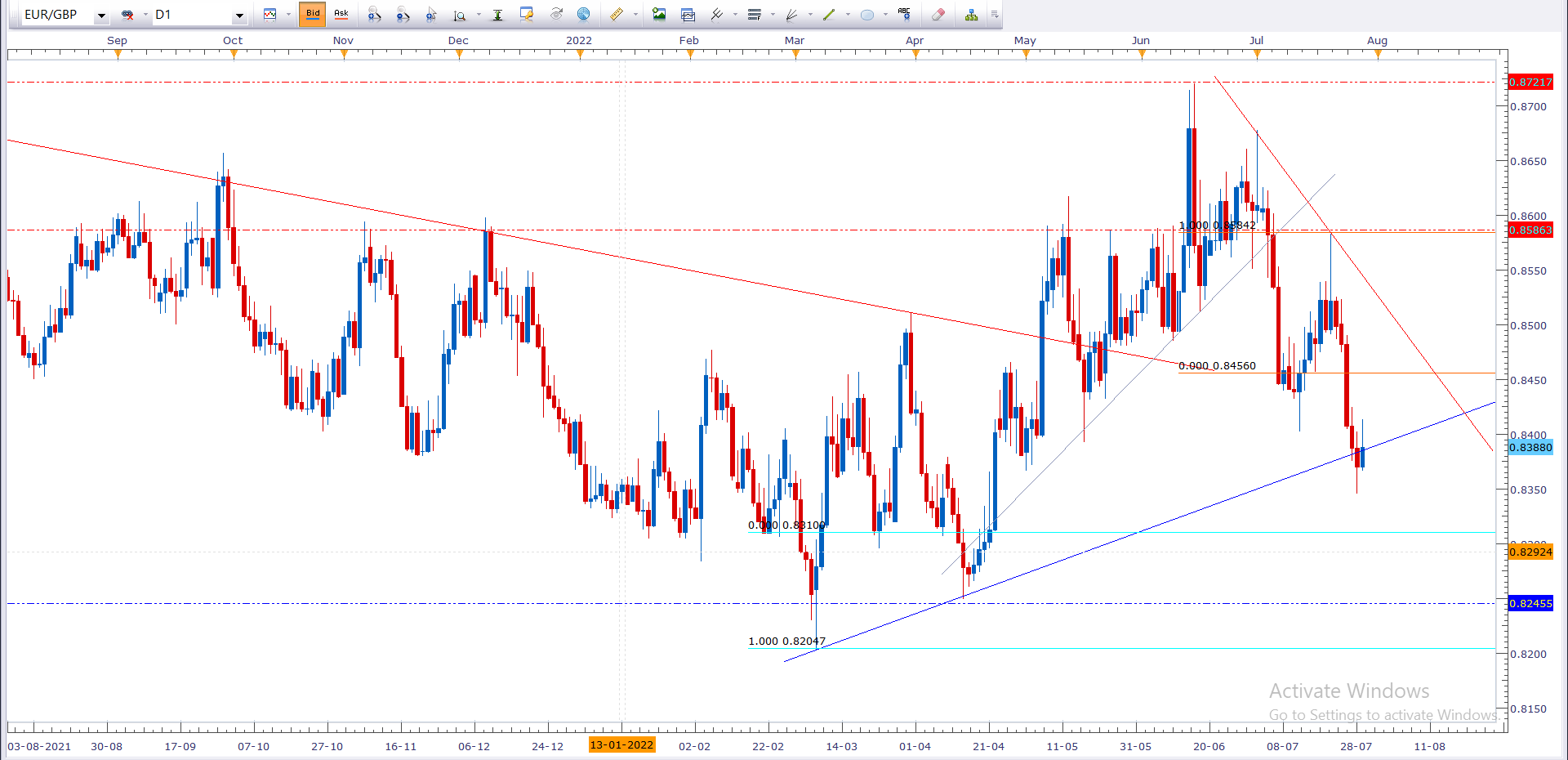

EUR GBP has been trading sideways between 0.824 and 0.873 for nearly an year and a half since February 2021. During the last two weeks the pair touched its upper limit and reversed to establish a lower HIGH followed by a lower low and then a lower HIGH on the Daily time frame to continue its downward run within the sideways limit. With continued GBP strength, the pair continues to move down and SHORTing the pair in a SELLERS' zone is the right trade.

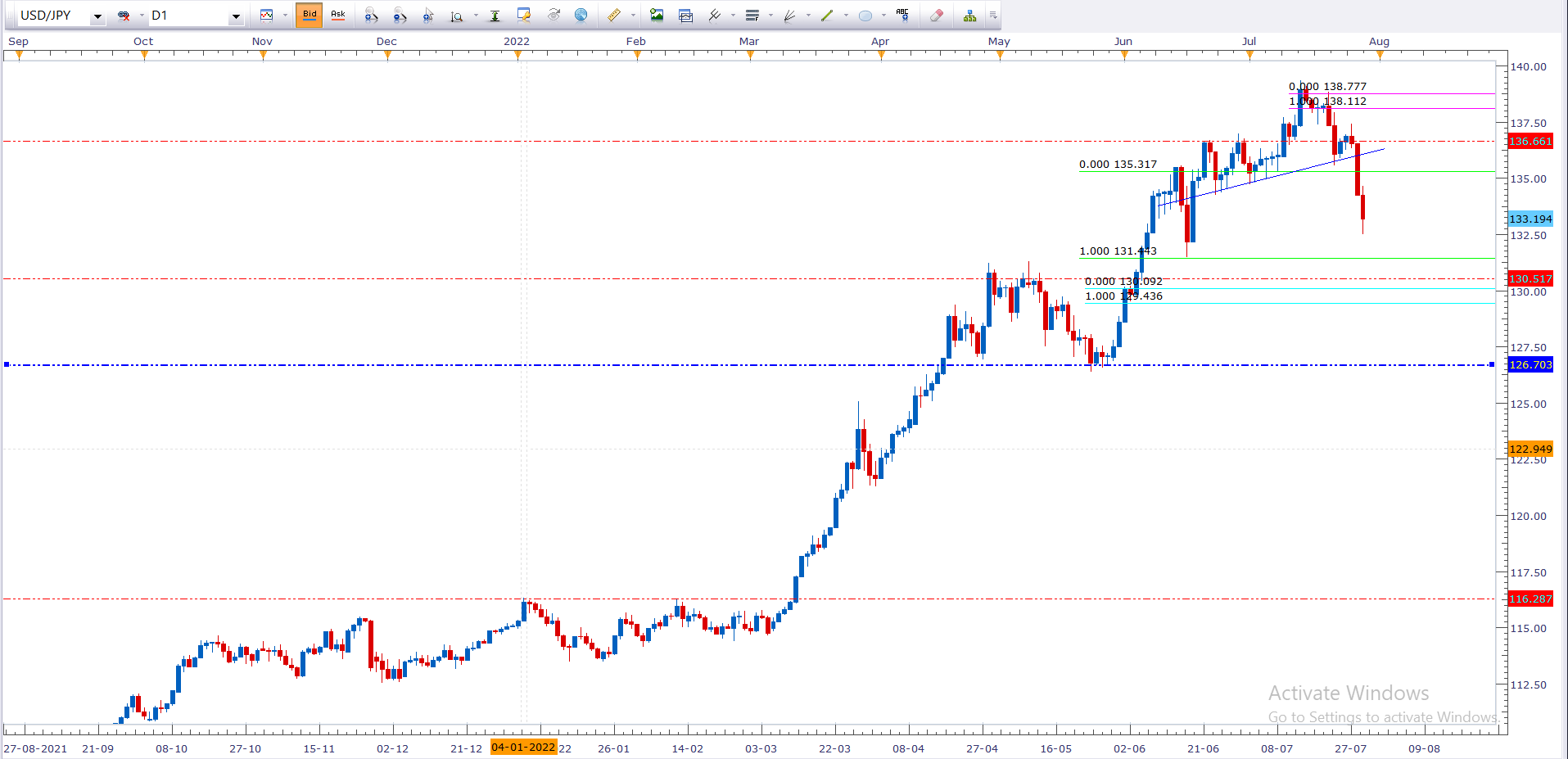

JPY has showed a lot of strength on Thursday and Friday printing two explosive RED CANDLES and it ahs printed a Lower HIGH and a Lower LOW on the Daily Time Frame. In order to continue with its Downtrend it needs to break below 130 which is a long distance off. Until then the 'SHORTS' need to be taken carefully.

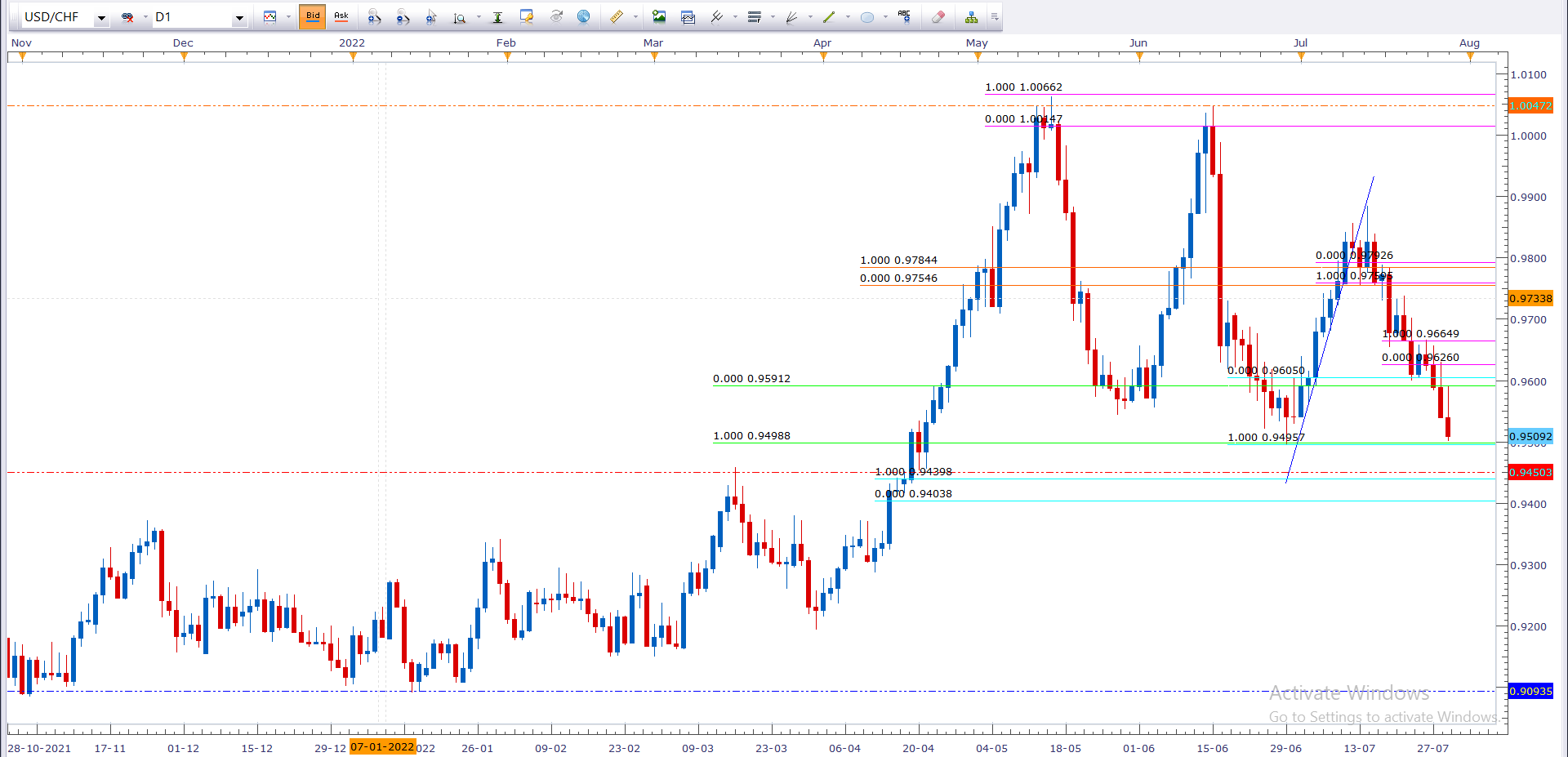

CHF has shown a lot of strength during last week's trading sessions and has managed to form a STRONG BEARISH candles on the Daily time frame. On the back of a weakness in USD, it has managed to make it back to the lows that it had made on June 29th this year. We still need to see if it breaks below 0.94 and closes below that area to make a way for further downtrend.

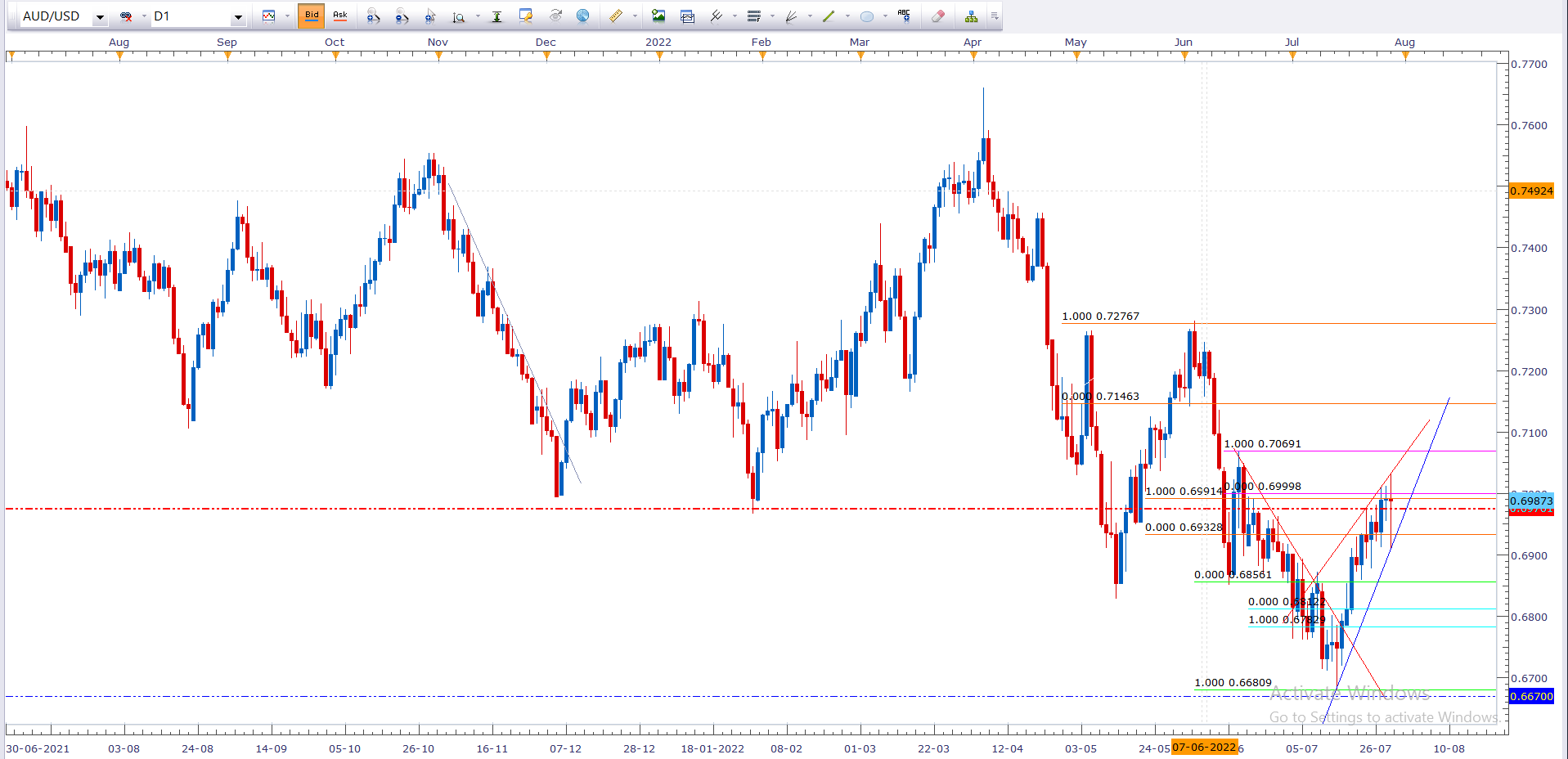

AUD USD like NZD USD printed a higher Low, but it's yet to print a higher HIGH on teh Daily frame, so Longs should be taken with caution.

CAD has lost some of its strength this week because of weeaness in Oil. With the interest rate decision from FOMC and the inflation data last week, the market took FOMC's stance as Dovish in future and USD took a beating last week. Hence, the pair moved down to print a new low as compared to recent weeks.

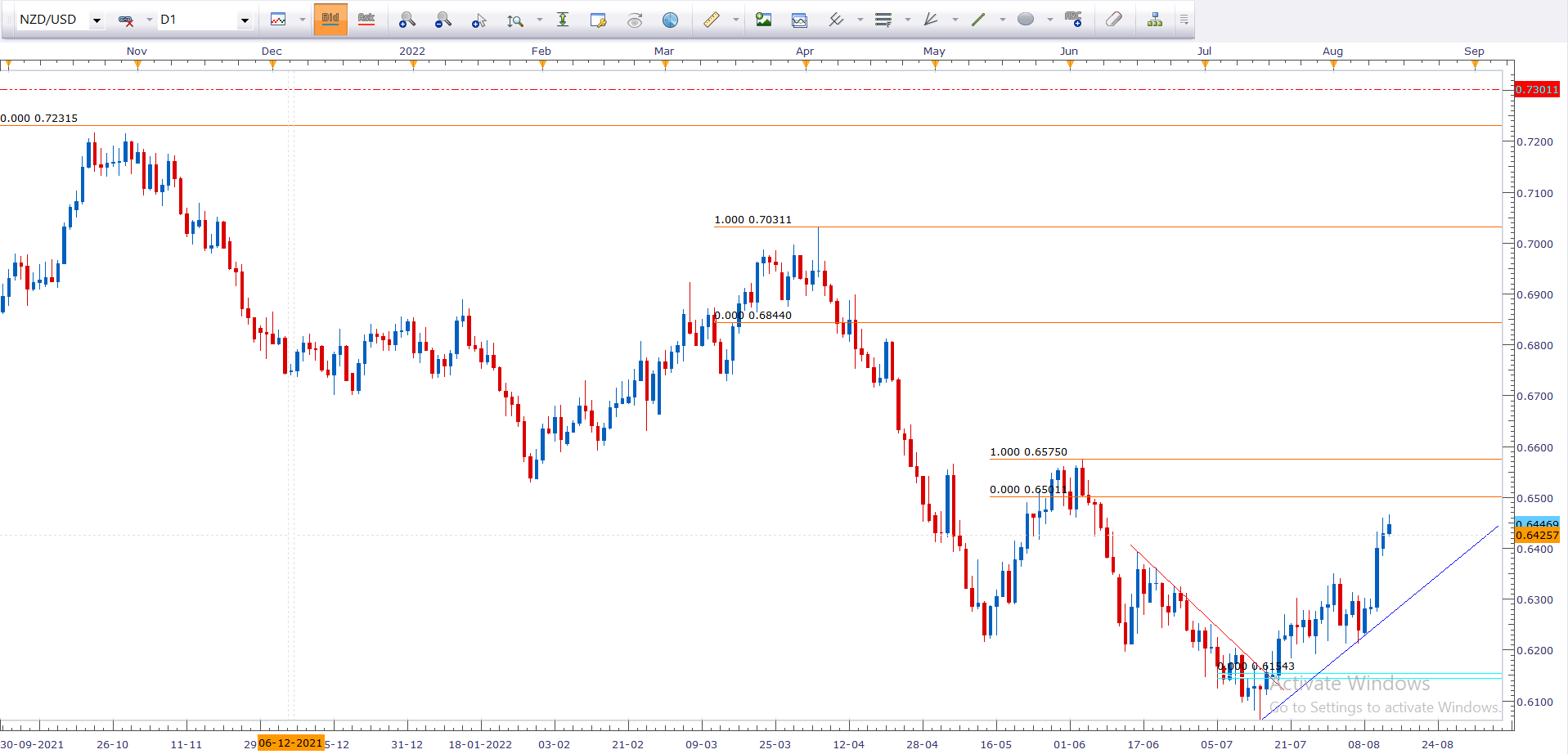

With USD losing some of its strength, NZD USD has pair shown a lot of strength in week 33 and the pair is moving towards a SELLERS' zone above 0.6500

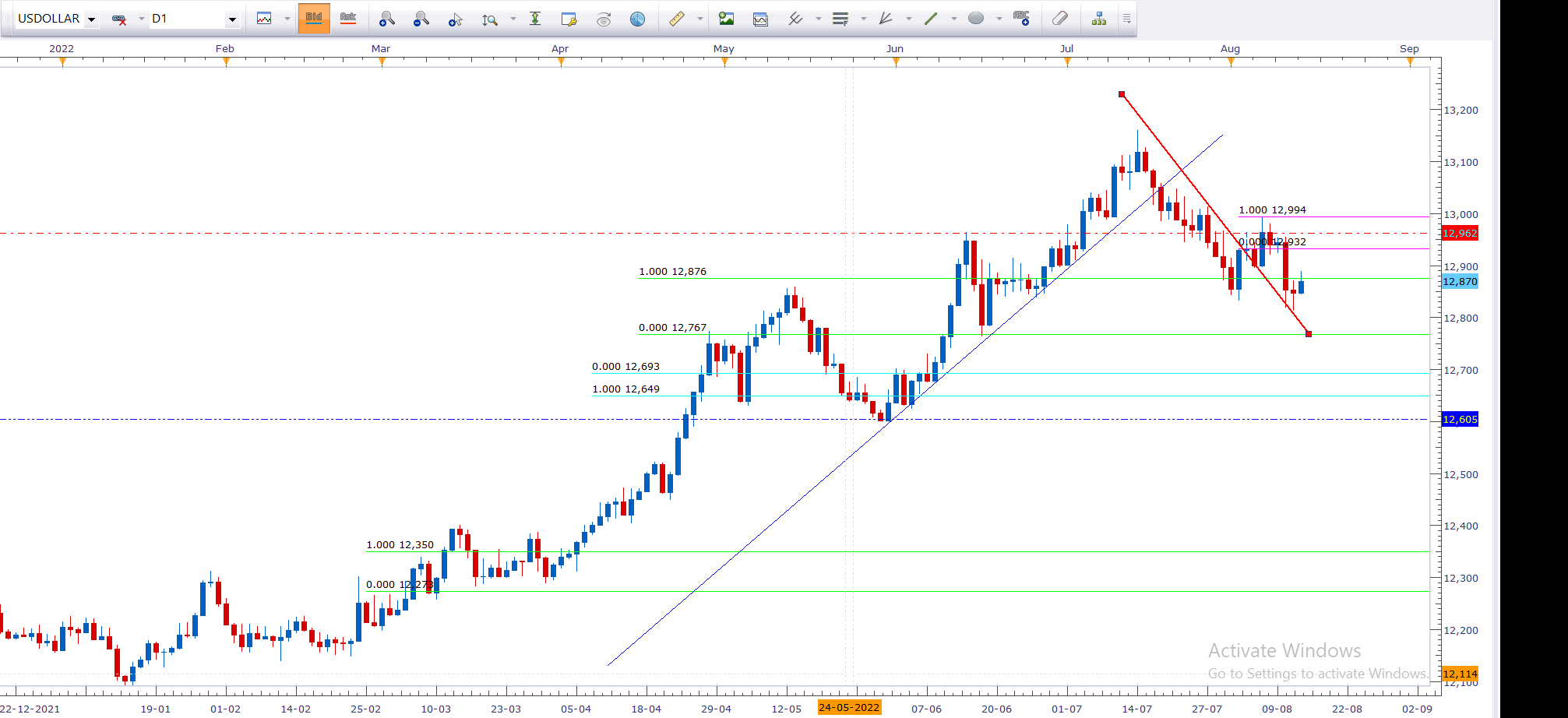

US DOLLAR INDEX fell off its highs and made a lower HIGH and a lower LOW on the back of lower than expected inflation report and FOMC interest rate revision announcement in week 32 followed by a weak report in week 33..

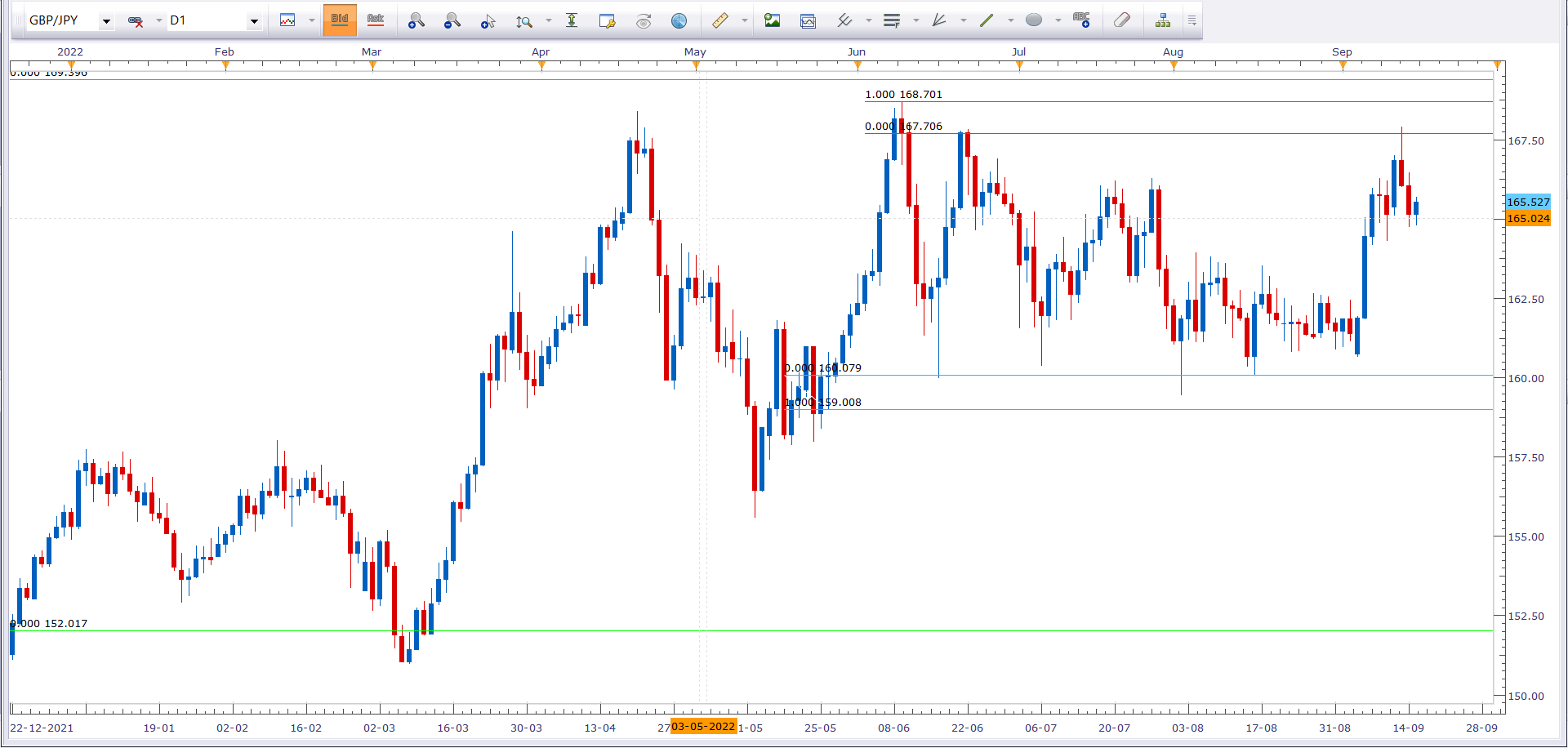

GBP JPY is currently in a SELLERS' area on the Daily chart and if it manages to reach the 170 area, it may enter the weekly area. a lo depnds on the USD and GBP rate hike scheduled for Week 40. So one needs to be careful with Swing or long term trades.